General information only; not financial or tax advice. Laws and lender policies change—verify specifics before acting.

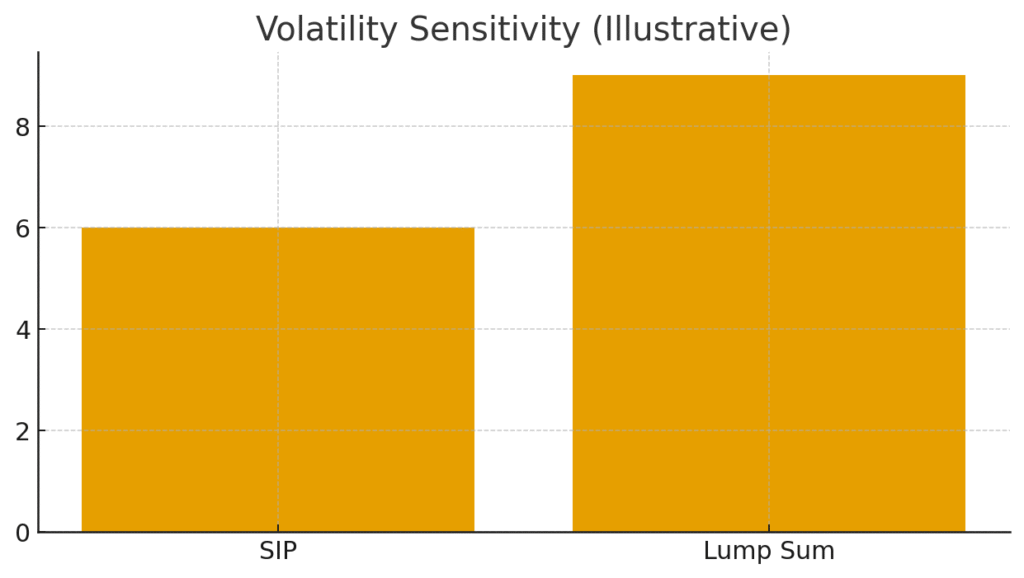

SIP smooths entry; lump sum maximises time-in-market (with timing risk).

Systematic Investment Plans (SIPs) average market entries and suit salaried cash flows. Lump sum investing gives immediate exposure but is sensitive to timing.

- Use SIPs for ongoing income and to reduce behavioural mistakes.

- Use lump sum for large windfalls; consider tranche deployment.

- Match approach to risk tolerance and market conditions.