This article is general information, not financial advice. Please verify terms with your bank/NBFC before acting.

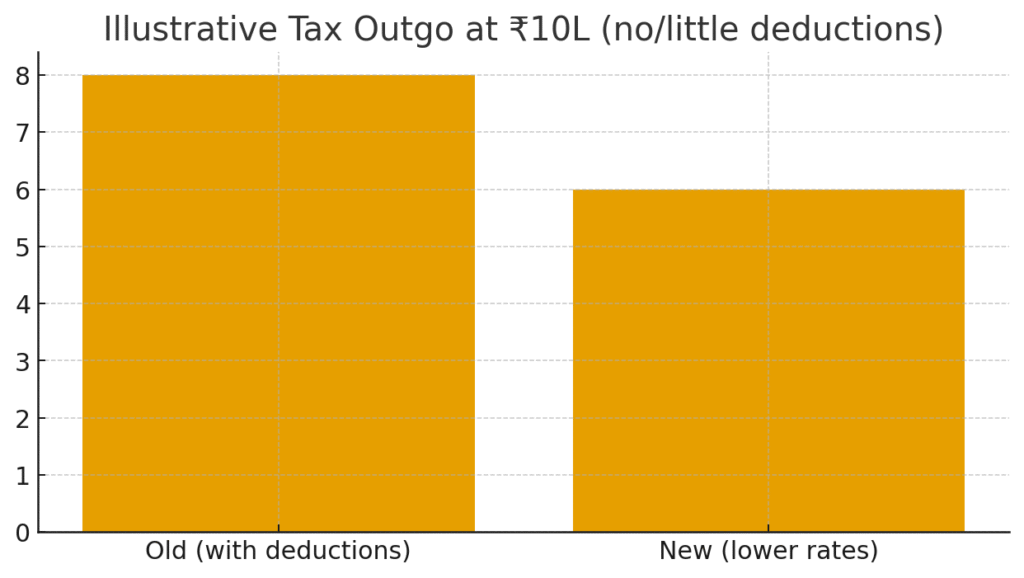

Pick based on deductions profile; numbers are indicative.

The new regime offers lower slab rates but restricts most deductions. The old regime allows HRA, 80C/80D, home loan interest and more.

Rule of thumb: minimal deductions → new regime; large deductions/exemptions → old regime. Always run both scenarios before filing.

- Salaried can choose annually; revisit each FY.

- Consider employer NPS contribution benefits in new regime.

- Use a calculator to find your breakeven deduction level.