General information only; not financial or tax advice. Laws and lender policies change—verify specifics before acting.

Illustrative only; confirm caps and policies when investing.

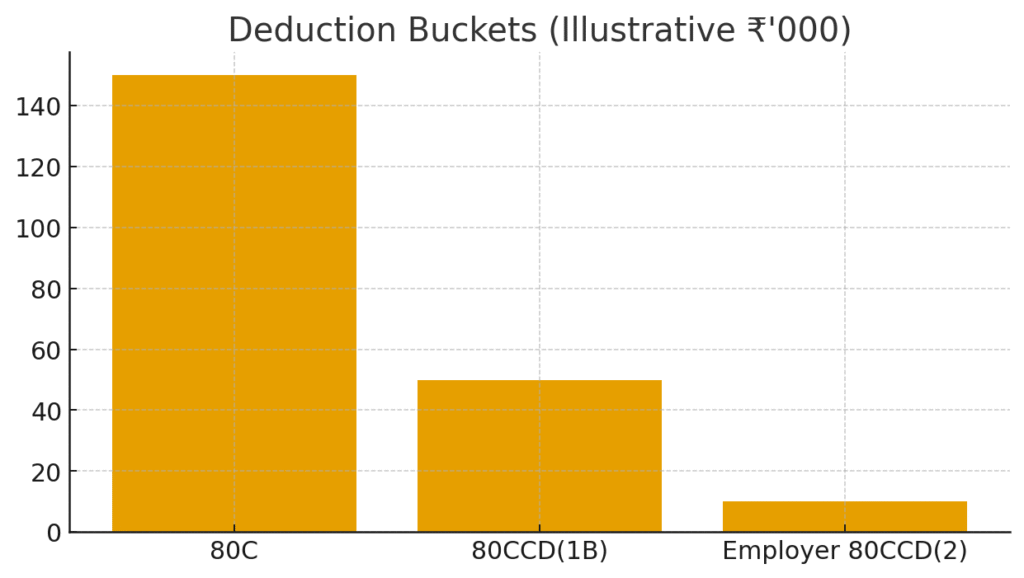

NPS offers an additional tax deduction via 80CCD(1B) over and above 80C. Employer contributions up to a percentage of salary may also be deductible—review your CTC structure.

Balance tax benefits with liquidity and retirement goals.

- Tier‑1 is primarily for retirement; withdrawals are regulated.

- Low cost structure; choose asset allocation based on age and risk.

- Consider auto‑choice vs active choice for simplicity.