General information only; not financial or tax advice. Laws and lender policies change—verify specifics before acting.

Lower utilisation signals prudent credit behaviour.

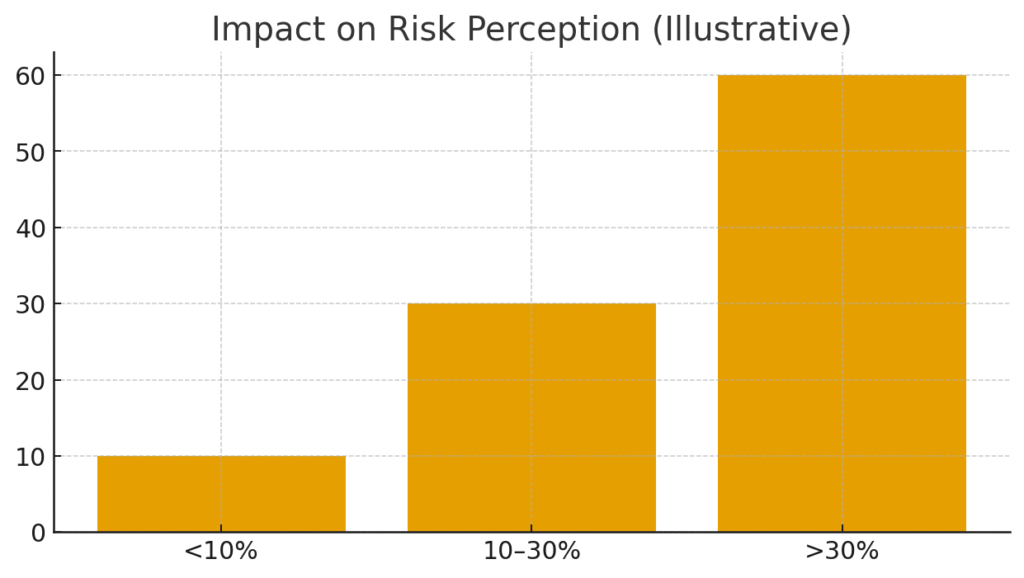

Credit utilisation is the share of your credit limits that you use. High utilisation indicates

stress and can depress your score.

Keep reported balances low by spreading spends, making mid‑cycle payments, or

increasing limits without increasing spending.

- Target <30% per card and overall; <10% is ideal for scores.

- Automate bill payments; monitor statements to avoid surprises.

- Avoid new debt while repairing high utilisation months.