This article is general information, not financial advice. Please verify terms with your bank/NBFC before acting.

Illustrative weightage; bureaus don’t disclose exact formula.

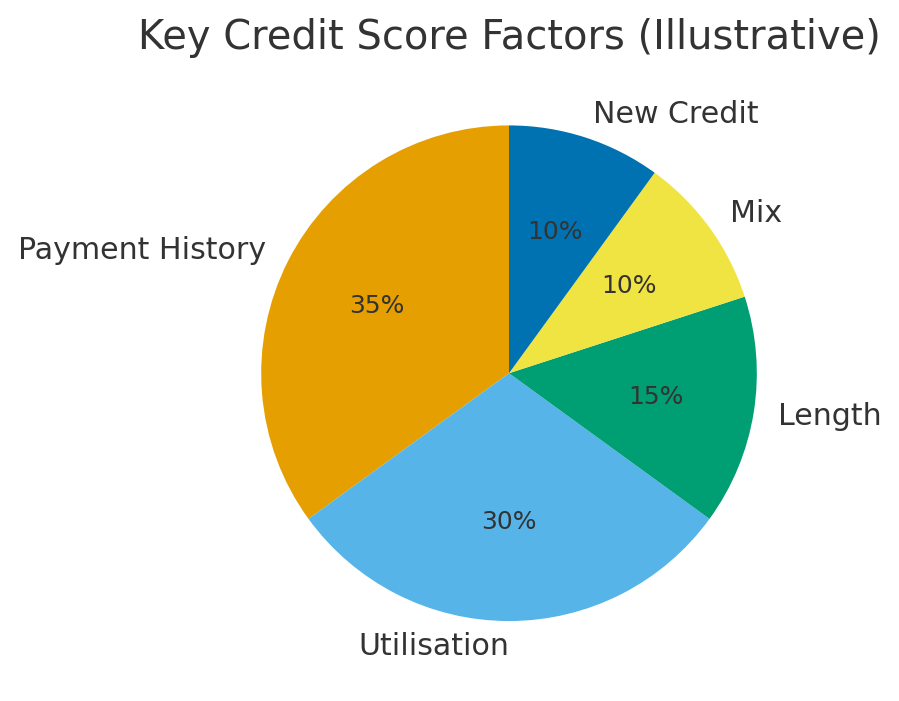

Credit bureaus evaluate several dimensions: payment history, utilisation, credit age, mix, and recent inquiries.

A strong score eases approval, improves terms, and can unlock higher limits.

- Prioritise on-time payments; set reminders or auto-debit.

- Keep revolving balances low; target <30% utilisation.

- Limit new applications; let accounts age to strengthen profile.